Heading back to School!

I hope you continue to be safe and avoid the virus. Data shows us the virus will find the soft spots in our country to flourish, and that the areas affected move around a lot. Currently, many mid-western states are seeing cases and hospitalizations going up, while they are going down in other areas.

A big, new wild card in the equation is students going back to school. While that may be of concern as it relates to potential increases in cases, the past month has introduced other events that have weathered well. For example, the NBA, MLB, PGA, MLS and other sports have resumed their seasons. While there have been some games postponed due to infections, my impression is that those leagues are doing better than some had expected. I hope the same will be true for the schools.

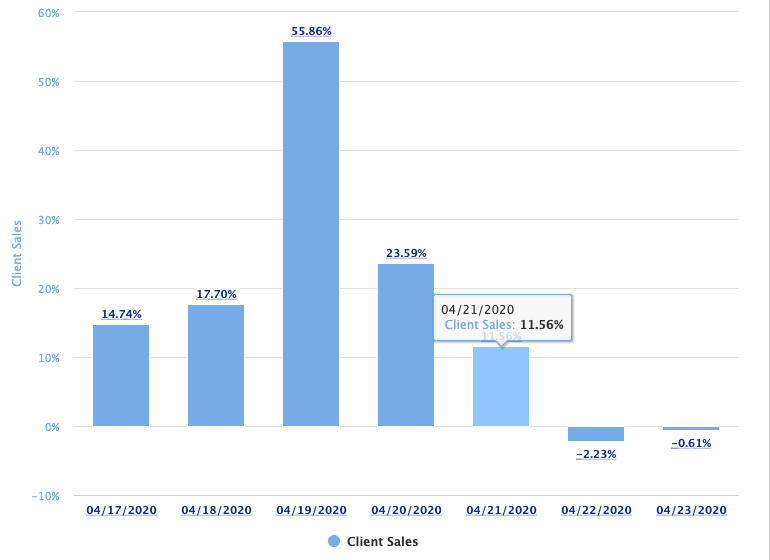

A coincidental event to the return to school each year is Labor Day. And, after a summer of slow but steady improvement in restaurant sales and traffic, the holiday created a bit of optimism with the volume of business that restaurants experienced. Before we get into the most recent holiday, let's review where we've been.

Covid Impact Recap

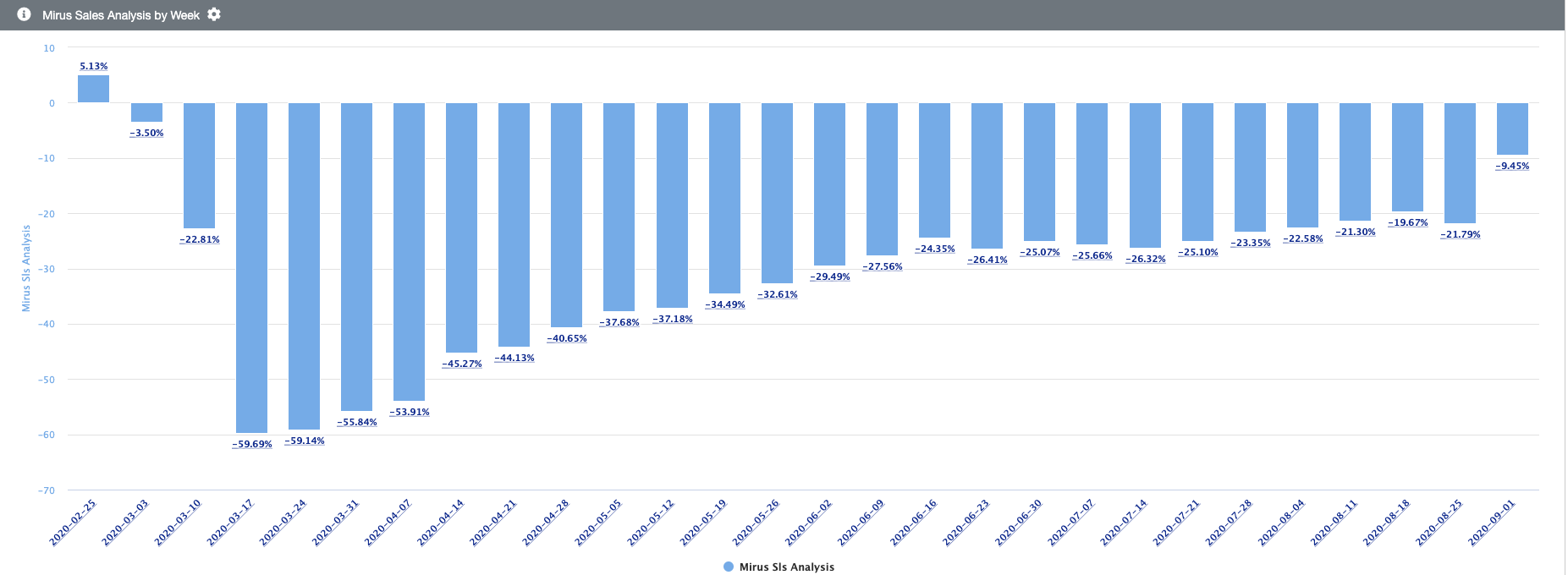

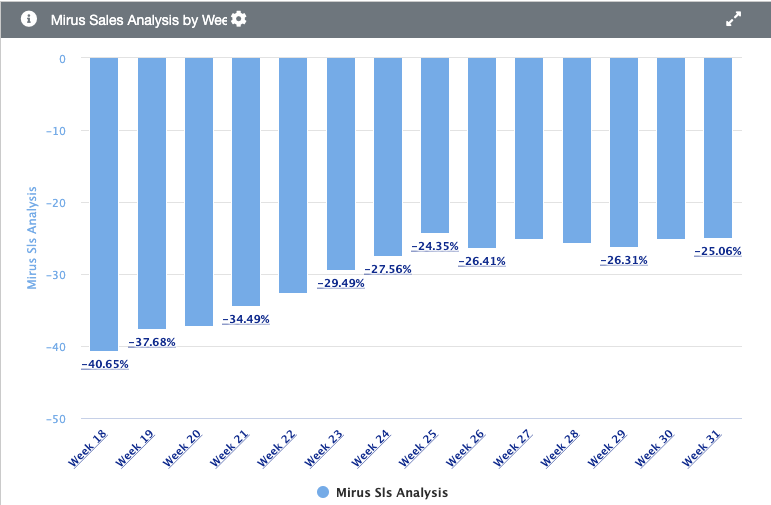

Mirus Index, which is a same-store comparison to the same day last year, is stuck around -20%. This means that, on average, a Mirus client location that is open today is generating about 80% of the sales it had last year. It is important to keep in mind that this is the average, and averages can be misleading in both directions. For example, more than half of our clients are experiencing sales that are better than -6%. But for others, the impact of Covid has been far more dramatic, with sales hovering around -50%, or worse in a few cases.

.png?width=50&height=50&name=Mirus%20Logo%20(1).png)